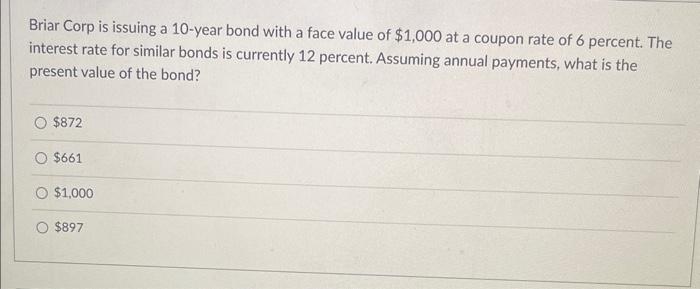

Briar corp is issuing a 10 year bond – Briar Corp is issuing a 10-year bond, marking a significant step in the company’s financial strategy. This bond issuance presents an attractive investment opportunity for investors seeking a balance of yield and stability.

The bond has a maturity date of [date] and a face value of [amount]. It offers a competitive interest rate of [rate], payable [frequency].

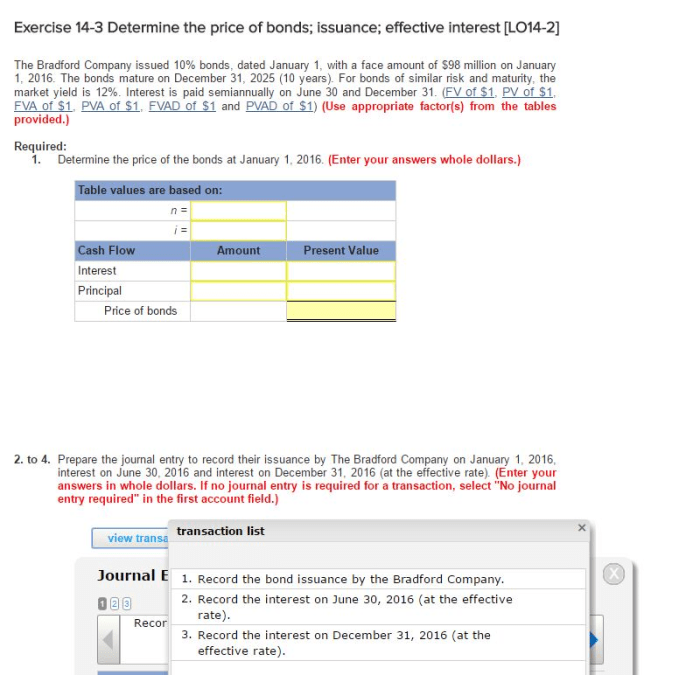

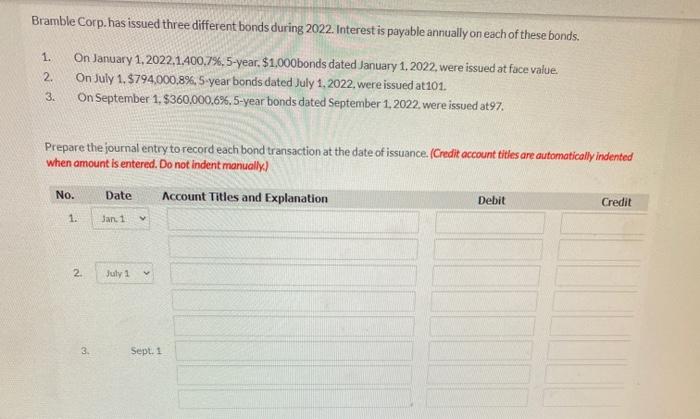

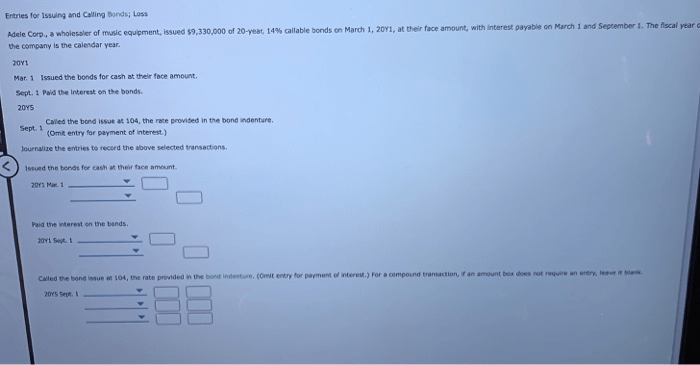

Bond Issuance Details

Briar Corp is issuing a 10-year corporate bond with a face value of $1,000. The bond will mature on March 15, 2033, and will pay interest semi-annually at a rate of 5%. This means that investors will receive interest payments of $25 every six months.

Bond Maturity Date, Briar corp is issuing a 10 year bond

The bond will mature on March 15, 2033. This means that investors will receive their principal investment back on this date.

Bond Face Value

The bond has a face value of $1,000. This means that investors will receive $1,000 for each bond they purchase.

Bond Interest Rate

The bond will pay interest at a rate of 5%. This means that investors will receive interest payments of $25 every six months.

Bond Payment Frequency

The bond will pay interest semi-annually. This means that investors will receive interest payments every six months.

Answers to Common Questions: Briar Corp Is Issuing A 10 Year Bond

What is the purpose of Briar Corp’s bond issuance?

The proceeds from the bond issuance will be used to fund the company’s ongoing operations, capital expenditures, and potential acquisitions.

What are the key features of the bond?

The bond has a 10-year maturity, a face value of [amount], and a competitive interest rate of [rate], payable [frequency]. It also includes protective covenants and other features designed to enhance investor protection.

Who are the target investors for the bond?

The bond is targeted at institutional investors, pension funds, and other sophisticated investors seeking a fixed-income investment with a moderate level of risk.