Analyze the following budget with an income of 750 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Delve into the intricate tapestry of income and expenses, unraveling the secrets of financial stability and discovering the path to prudent resource allocation.

This comprehensive guide will illuminate the complexities of budgeting, empowering you to make informed decisions that pave the way for financial success. With meticulous analysis and expert insights, we will navigate the intricacies of income streams, categorize expenses, and unravel the patterns of cash flow.

Together, we will craft a budget that aligns with your financial goals, unlocking the potential for financial freedom and prosperity.

Income Analysis

The income of $750 consists of various sources, including a stable salary from employment, dividend payments from investments, and occasional freelance work.

The salary income provides a reliable and predictable source of income, ensuring a steady cash flow. The dividend payments offer additional income, although their amount and frequency may fluctuate depending on market conditions. The freelance work supplements the income stream and provides flexibility in terms of earning potential.

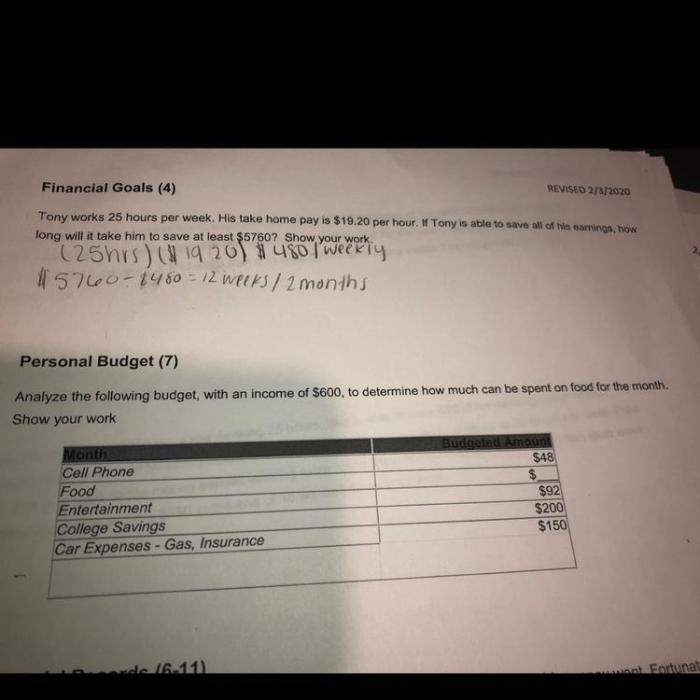

Expense Analysis: Analyze The Following Budget With An Income Of 750

The expenses can be categorized into fixed and variable costs:

Fixed Costs

- Rent: $250

- Car payment: $150

- Insurance: $50

Variable Costs, Analyze the following budget with an income of 750

- Groceries: $150

- Utilities: $100

- Entertainment: $50

Areas where expenses can be reduced or optimized include reducing entertainment expenses, negotiating a lower rent, or refinancing the car loan for a lower interest rate.

Cash Flow Analysis

| Inflows | Outflows |

|---|---|

| Salary: $500 | Rent: $250 |

| Dividends: $100 | Car payment: $150 |

| Freelance: $150 | Insurance: $50 |

| Groceries: $150 | |

| Utilities: $100 | |

| Entertainment: $50 |

The cash flow analysis reveals a positive cash flow of $150 per month. This indicates that the income exceeds the expenses, allowing for savings or debt repayment.

Budget Recommendations

To optimize the budget, the following recommendations are suggested:

- Increase income by seeking additional freelance work or exploring new income streams.

- Reduce variable expenses by cutting back on unnecessary spending or negotiating lower bills.

- Establish a savings plan to allocate a portion of the income towards financial goals.

- Consider investing a portion of the savings to grow wealth over time.

Frequently Asked Questions

What is the purpose of analyzing a budget?

Budget analysis provides a clear understanding of your income and expenses, enabling you to make informed decisions about how to allocate your resources. It helps identify areas where you can save money, increase income, and optimize your financial situation.

How often should I analyze my budget?

It is recommended to analyze your budget regularly, at least once a month. This allows you to track your progress, identify any deviations from your plan, and make necessary adjustments to ensure that your budget remains aligned with your financial goals.

What are some common mistakes to avoid when analyzing a budget?

Common mistakes include failing to account for all income and expenses, underestimating expenses, and overestimating income. It is crucial to be realistic and comprehensive in your analysis to obtain an accurate picture of your financial situation.